WEEK that was

Markets have completely forgotten the Russia-Ukraine tension. FIIs have become net buyers this week. Banknifty showed some extra muscle compared to other indices rising 10% this month

MWM has closed March month with a gain of 9.3%

Here is a weekly update on our strategies.

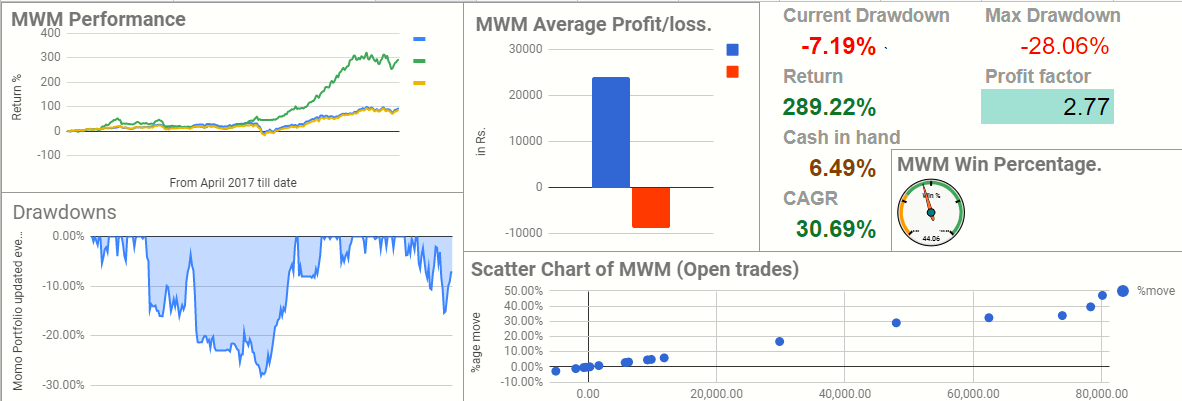

MWM website gained 2.11% this week to close at 289.22% total returns. Our Overall outperformance to benchmarks is now at 197.94% The current Drawdown stands at –7.19%. We have averaged 30.69% CAGR since April 2017.

This week will have 2 entries in both MWM website and Smallcase.

You need to subscribe to this newsletter in order to receive Rebalance update in advance. Please read this blog detailing the rebalance process.

Now is a good time as any to bring your attention to the power of Asset Allocation. Your exposure should be in accordance to your pain thereshold. Please watch this Video we prepared to bring this point home.

If you had 70:30 MWM/Gold. Your current Drawdown would have been 2%

#MWM is a 20 stock Automated, Multi-cap Model portfolio selected on the basis of Price momentum. It has broader market filters to sit in cash in bear markets.

#MWM is a wonderful way to take “Momentum” factor exposure in your portfolio. The entire idea is to capture the Alpha, by falling lesser than the broader markets in bad days and be with fast movers in good days.

Mystic Wealth value gained 3.48% this week. Our Overall return stands at 126.85% since inception. Which is 17.51% CAGR. We have 15% in cash. Strategy outperformance to benchmarks stand at 35.57%

This week will have 1 entry in (management change theme) both MWV website and smallcase.

MWV is run by Dayanand Deshpande who is considered an authority on Special situation Investing in India. Over the years, Demergers as a theme has generated amazing wealth for our long term clients.

Checkout our MWV strategy page on website

To know more about underlying philosophy at MysticWealth Value (MWV). Please watch this detailed webinar

Interview with Scientific Investing

Compared to value investing, momentum is still in its nascent stage. We are trying to bridge that gap by spreading awareness. Part of that endeavour, Saurabh Kumar of Scientific investing interviewed Manish Dhawan of MysticWealth and asked some nuanced questions around Momentum Investing. Listen to this fascinating conversation here

Thats it for the week guys. Have a great weekend.

Cheers

MysticWealth.