WEEK that was

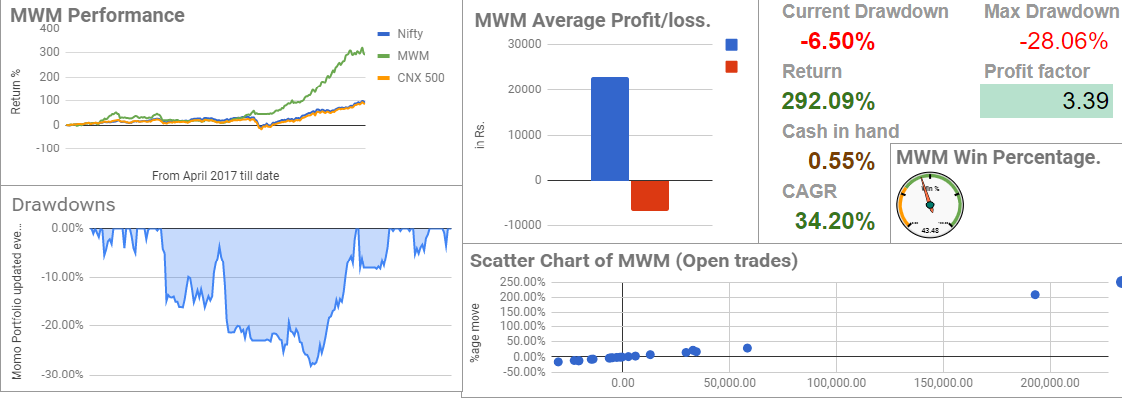

The correction intensified this week with NIFTY taking it on the chin. Broader market was not as badly hit. Surprisingly MWV has come out unscathed in this correction. MWM current drawdown stands at -6.50%

Here is a weekly update on our strategies.

MWM website lost -1.58% this week to close at 292.09% returns since inception. Our Overall out performance to benchmarks is at 200.79%

The current draw down is at -6.50%

This week will have 6 Exit and 5 Addition in MWM website and

05 exit and 05 addition in MWM smallcase.

You need to subscribe to this newsletter in order to receive Rebalance update in advance. Please read this blog detailing the rebalance process.

Smallcase is up 106.48% year on year. You can download the smallcase excel sheet from here

#MWM is a 20 stock Automated, Multi-cap Model portfolio selected on the basis of Price momentum. It has broader market filters to sit in cash in bear markets.

#MWM is a wonderful way to take “Momentum” factor exposure in your portfolio. The entire idea is to capture the Alpha, by falling lesser than the broader markets in bad days and be with fast movers in good days.

Watch this Webinar we did explaining MWM philosophy in detail.

Please note that MWM smallcase and MWM website have separate set of stocks now and therefore performance would be different. Please find below MWM smallcase graph.

Mystic Wealth value was up 1.92% this week. Our Overall return stands at 140.31% returns since inception. Which is 20.75% CAGR. We have 17% still in cash. Strategy outperformance to benchmarks stand at 49%

There are NO changes this week.

MWV is run by Dayanand Deshpande who is considered an authority on Special situation Investing in India. Over the years, Demergers as a theme has generated amazing wealth for our long term clients.

Checkout our MWV strategy page on website

Watch This webinar where he explains the entire concept in easy to understand language.

#MWO. MysticWealth Options:

MWO is a Risk defined Option writing Model portfolio aimed at generating income from idle (cash/pledge). We aim to generate 18-25% annual return with around same drawdowns.

Our Current DD is at 18.43%. with a total return of 40.98% (7.70% CAGR)

You can know more about MWO here.

Have a Great weekend!!!

Cheers.