WEEK that was

Interest rates are getting raised the world over. US raised it the biggest it did in the last 28 years. Bond yields are moving up. Cryptos are crashing and so are stocks while the Gold is NOT rallying yet. This in a nutshell has how the last two weeks panned out.

Here is a weekly update on our strategies.

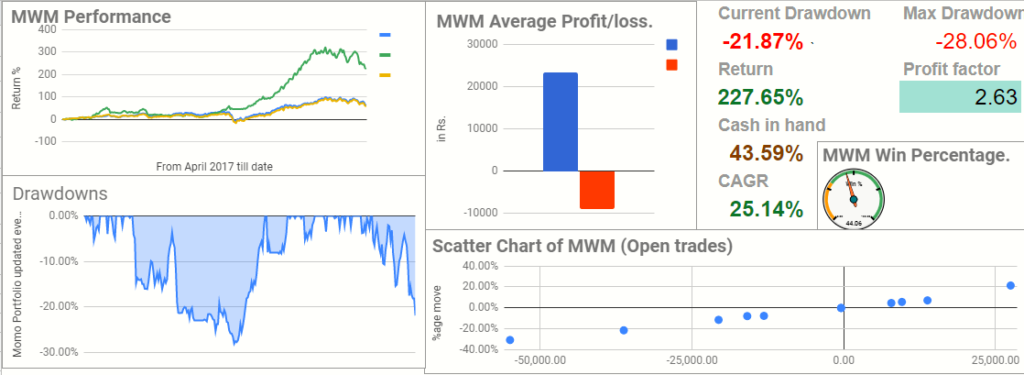

MWM lost –-4.55% this week to close at 227.65% total returns. Our Overall outperformance to benchmarks is at 162.11%. The current Drawdown stands at –21.87%. We have averaged 25.14% CAGR since April 2017.

This week will have 9 Exits and 0 entries in MWM.

These are challenging times for Momentum and there is Nothing New happening!!. To understand how Momentum Investing works in the long run and how drawdowns are part of the game, please spare some time and watch this in-depth

conversation.

Mystic Wealth value lost -3.85% this week. Our Overall return stands at 105.60% since inception. Which is 14.59% CAGR. We have 10% in cash. Strategy outperformance to benchmarks stands at 40.05%

This week will have 1 New Entry and NO Exits.

MWV is run by Dayanand Deshpande who is considered an authority on Special situation Investing in India. Over the years, Demergers and management change as a theme has generated amazing wealth for our long-term clients.

To know more about the underlying philosophy at MysticWealth Value (MWV). Please watch this detailed webinar

TELEGRAM Channel.

To enable fast and prompt communication, we have launched a Telegram channel. Please subscribe to the channel to receive an instant update on our latest blog, video, and rebalance updates.

Happy Weekend.

MysticWealth.